So, you’re planning a trip to Zambia and wondering if you can rely on your trusty credit card to make those seamless transactions, huh? Well, let me fill you in on the current state of affairs. When it comes to credit card acceptance in Zambia, it’s a bit of a mixed bag. While major hotels, upscale restaurants, and larger retail outlets might give you the green light to swipe away, you may encounter some limitations in smaller towns and local markets. So, it’s always a good idea to have some cash on hand, just in case. Let’s dive into the ins and outs of credit card acceptance in Zambia, so you know what to expect before you jet off on your adventure.

Overview of Credit Card Usage in Zambia

Credit card usage in Zambia has seen significant growth over the past decade. While it may not be as widespread as in some developed countries, the use of credit cards is increasing steadily. This article will provide an overview of credit card usage in Zambia, including its history, current penetration rates, acceptance in major cities, availability in rural areas, factors influencing acceptance, popular credit card brands, alternative payment methods, advantages and disadvantages of accepting credit cards, security concerns, and tips for credit card usage.

History of Credit Card Usage in Zambia

The history of credit card usage in Zambia can be traced back to the early 2000s when international financial institutions and banks started introducing credit card services in the country. Initially, credit cards were mainly used by individuals with high income levels, frequent travelers, and business owners who needed a convenient and secure payment method. Over time, as the Zambian economy grew and technology advancements were made, credit card usage became more accessible to the wider population.

Current Credit Card Penetration in Zambia

Currently, credit card penetration in Zambia is relatively low compared to other countries. According to the Bank of Zambia, as of 2021, there are approximately 500,000 active credit cardholders in the country. This represents a small percentage of the total population of Zambia. However, the number of credit cardholders has been steadily increasing, indicating a growing trend towards credit card usage.

Acceptance of Credit Cards in Major Cities

Lusaka

Lusaka, being the capital city of Zambia, has a higher acceptance rate for credit cards compared to other cities. Most major banks, hotels, restaurants, and retail stores in Lusaka accept credit card payments. It is relatively easy to find places that have Point of Sale (POS) machines for credit card transactions. However, it is always advisable to carry some cash as a backup form of payment, as there may still be some establishments that do not accept credit cards.

Kitwe

In Kitwe, the second-largest city in Zambia, credit card acceptance is also quite widespread. Many businesses, including shopping malls, supermarkets, and hotels, have adopted credit card payment methods. However, it is important to note that some smaller establishments, such as street vendors and local markets, may still primarily rely on cash transactions.

Ndola

In Ndola, another major city in Zambia, credit card acceptance has become increasingly common. Many hotels, restaurants, and larger retail stores in Ndola now have POS machines for credit card transactions. However, it is advisable to carry some cash when visiting smaller or more remote areas within Ndola, as credit card acceptance may be limited.

Livingstone

Livingstone, known for its proximity to the famous Victoria Falls, also has a growing number of businesses that accept credit cards. This is particularly true for hotels, lodges, and tourist attractions in the area. However, when venturing into more remote areas or engaging with smaller vendors, it is still wise to have cash on hand.

Availability of Credit Card Facilities in Rural Areas

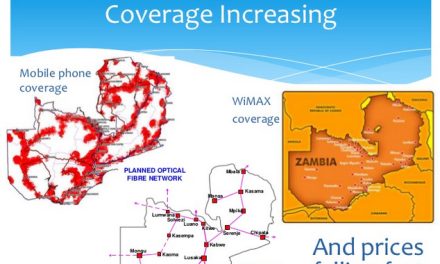

Challenges Faced by Rural Areas in Accepting Credit Cards

While credit card acceptance has become increasingly prevalent in major cities, rural areas in Zambia face several challenges when it comes to accepting credit cards. One of the main challenges is the lack of technological infrastructure, such as reliable internet connectivity and electricity, which are essential for credit card transactions. Additionally, the cost associated with setting up and maintaining credit card facilities is often prohibitive for businesses in rural areas.

Initiatives to Increase Credit Card Acceptance in Rural Areas

Recognizing the importance of promoting financial inclusion and expanding credit card usage beyond urban centers, various initiatives have been launched to increase credit card acceptance in rural areas of Zambia. These initiatives focus on improving the technological infrastructure, providing training and education to businesses on credit card acceptance, and offering financial incentives and support to businesses that adopt credit card facilities.

Factors Influencing Credit Card Acceptance in Zambia

Economic Factors

The state of the economy plays a significant role in the acceptance of credit cards in Zambia. When the economy is stable, businesses are more likely to invest in credit card facilities as they anticipate increased consumer spending. On the other hand, during periods of economic instability, businesses may be more cautious about investing in credit card infrastructure and may prioritize cash transactions.

Technological Factors

Technological advancements have a direct impact on credit card acceptance in Zambia. The availability and reliability of internet connectivity, the affordability of POS machines, and the ease of integrating credit card payment systems with existing business infrastructure all influence the willingness of businesses to accept credit cards. As technology continues to improve and become more accessible, credit card acceptance is expected to increase.

Regulatory Factors

Regulatory frameworks also play a crucial role in credit card acceptance. The government and regulatory bodies in Zambia have a responsibility to create an enabling environment for credit card usage. This includes setting clear guidelines for businesses to follow when accepting credit cards, ensuring consumer protection measures are in place, and encouraging financial institutions to offer competitive credit card products.

Popular Credit Card Brands Accepted in Zambia

Visa

Visa is one of the most widely accepted credit card brands in Zambia. Its global presence and reputation make it a preferred choice for many Zambian businesses. Visitors to Zambia who hold Visa credit cards can expect a high acceptance rate at various establishments across the country.

Mastercard

Mastercard is another popular credit card brand accepted in Zambia. Many businesses, especially those in urban areas, have partnered with Mastercard to offer their customers a wide range of payment options. Visitors with Mastercard credit cards can confidently use their cards at most major establishments.

American Express

While American Express is not as widely accepted as Visa and Mastercard in Zambia, some high-end hotels, luxury retailers, and international airlines do accept American Express cards. However, it is always advisable to have an alternative payment method when relying on American Express, as acceptance may be limited compared to other brands.

Alternative Payment Methods in Zambia

Mobile Money

Mobile money has gained significant popularity in Zambia, especially among the unbanked population. Services like MTN Mobile Money and Airtel Money allow individuals to conduct various financial transactions using their mobile phones, including paying bills, transferring money, and making purchases. Mobile money has become a widely accepted alternative to credit cards, particularly in rural areas where access to formal banking services is limited.

Cash

Cash remains the primary payment method in Zambia, especially in rural areas. Despite the growth of credit card usage, many businesses still rely on cash transactions. Carrying cash is essential when visiting remote areas or engaging in transactions with smaller vendors who may not have credit card facilities.

Debit Cards

Debit card usage in Zambia is also growing steadily. Many individuals prefer debit cards as they provide the convenience of electronic payments without the risk of accumulating debt. Debit cards issued by local banks are widely accepted for payment at various establishments, making them a reliable alternative to credit cards.

Advantages and Disadvantages of Credit Card Acceptance

Advantages of Accepting Credit Cards

Accepting credit cards offers several advantages to businesses in Zambia. Firstly, it expands the customer base by attracting individuals who prefer the convenience of using credit cards for their purchases. Secondly, credit card payments reduce the risk associated with handling cash, such as theft and counterfeit currency. Finally, credit card transactions are traceable, providing businesses with valuable data for analysis and decision-making.

Disadvantages of Accepting Credit Cards

While credit card acceptance has its advantages, there are also a few disadvantages to consider. Businesses that accept credit cards incur transaction fees, which can eat into their profits. Additionally, credit card fraud and chargebacks can be a concern, requiring businesses to implement robust security measures and protocols to protect themselves and their customers.

Security Concerns Regarding Credit Card Usage in Zambia

Fraud Prevention Measures

Banks and financial institutions in Zambia take credit card fraud prevention seriously. They employ various security measures such as two-factor authentication, encryption technology, and real-time transaction monitoring to detect and prevent fraudulent activities. Customers are also encouraged to protect their card details, regularly review their transaction history, and report any suspicious activity to their bank immediately.

Consumer Protection

Consumer protection laws in Zambia also play a crucial role in ensuring the security and fair treatment of credit card users. These laws outline the rights and responsibilities of both businesses and consumers, ensuring that credit cardholders are protected from fraudulent activities and unauthorized transactions.

Tips for Credit Card Usage in Zambia

Notify Your Bank Before Traveling to Zambia

Before traveling to Zambia, it is essential to notify your bank of your travel plans. This will prevent any inconvenience or potential card blockage due to suspicion of fraudulent activity when your card is used in a foreign country.

Carry a Backup Payment Method

While credit cards are generally accepted in major cities, it is always advisable to carry a backup payment method, such as cash or a debit card. This will ensure that you have an alternative option in case a business does not accept credit cards or experiences technical difficulties.

Be Cautious While Using Credit Cards in Rural Areas

When using credit cards in rural areas of Zambia, it is important to exercise caution. Ensure that the establishment accepting your card appears reputable and trustworthy. Additionally, be mindful of your personal information and card details when making transactions, as hackers and scammers can target less secure areas.

Conclusion

Credit card usage in Zambia has witnessed significant growth, although it is not as widespread as in some developed countries. Major cities like Lusaka, Kitwe, Ndola, and Livingstone have seen an increasing acceptance of credit cards, while rural areas face challenges in adopting credit card facilities. Factors such as economic conditions, technological advancements, and regulatory frameworks influence credit card acceptance in Zambia. Visa, Mastercard, and American Express are the popular credit card brands accepted in the country. Alternative payment methods like mobile money, cash, and debit cards provide additional options for transactions. While credit card acceptance offers advantages such as expanding customer base and reducing cash-related risks, businesses need to be mindful of transaction fees, fraud prevention measures, and consumer protection. By following tips such as notifying your bank before travel and carrying a backup payment method, you can safely and conveniently use credit cards in Zambia.